FDI, INFRASTRUCTURE AND GOVERNANCE IN AFRICA

According to the United Nations, in 2016, the top five foreign investors in the African continent, in terms of FDI stock, were the United States (USD 57 billion), the United Kingdom (USD 55 billion), France (USD 49 billion), China (USD 40 billion) and Italy (USD 23 billion).

Foreign investment flows to the continent fell by 21% in 2017 compared to 2016. The total value of FDI flows to Africa for 2017 amounted to $42 billion (13 billion to North Africa and $29 billion to sub-Saharan Africa). Intracontinental FDI flows, on the other hand, increased by 8%, mainly thanks to Moroccan and South African companies.

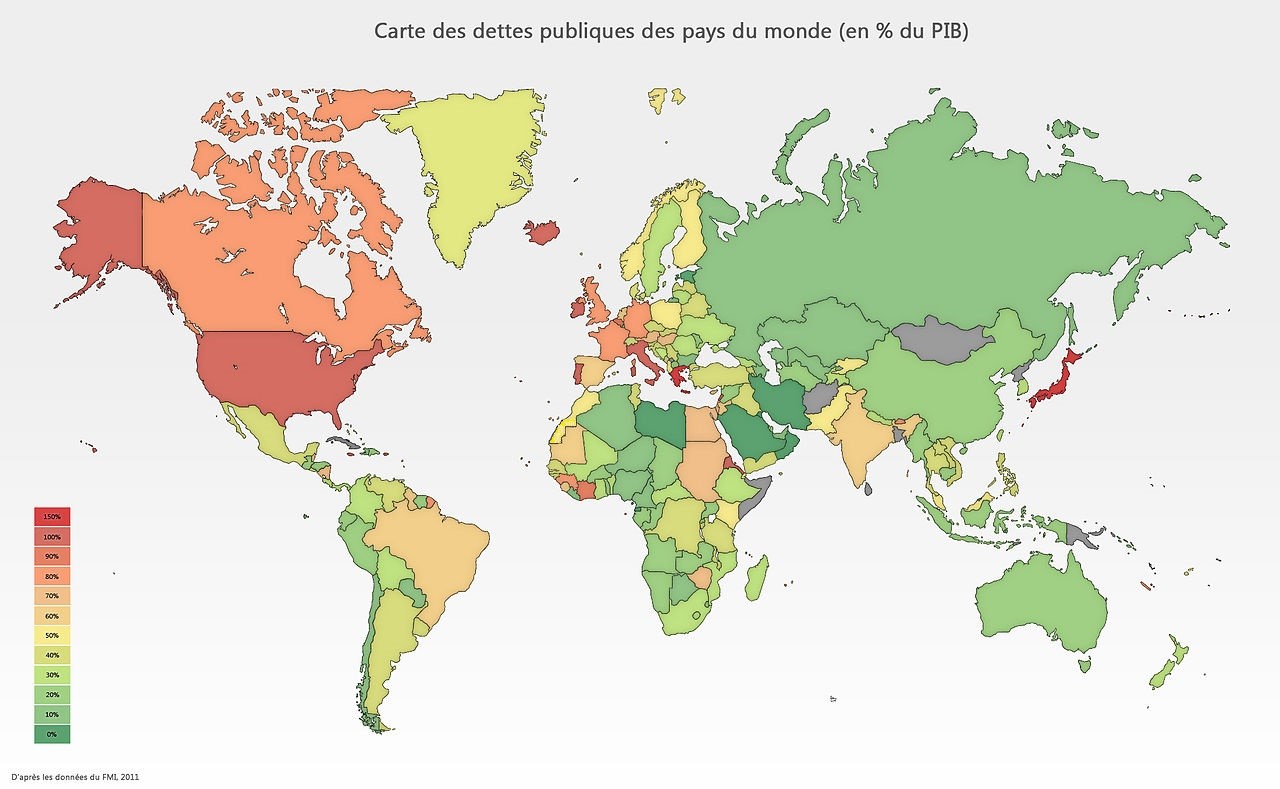

Debt

The 1980s and 1990s were marked by the debt crisis. The rise in interest rates and the decline in export revenues plunged the continent into a financial crisis that led to the implementation of structural adjustment programs. At the same time, public aid to Africa decreased significantly, redirected towards Eastern Europe. It was the era of "Goodbye Bangui, hello Warsaw". The political and economic organization of States was drastically revised, particularly through the dismantling of state apparatuses deemed costly and inefficient as well as the dismantling of parastatal companies with questionable competitiveness.

This liberal purge creates the 'adjusted generation' or 'deflated generation.' However, when combined with the reversal of international cycles in terms of interest rates, a resumption of public aid to Africa and a resumption of foreign direct investments since the year 2000 particularly with strong Chinese involvement), which leads to a decrease in the debt burden in the finances of States. By the end of the first decade of the 21st century, Africa is less indebted than developed Western countries, although its debt remains under control.

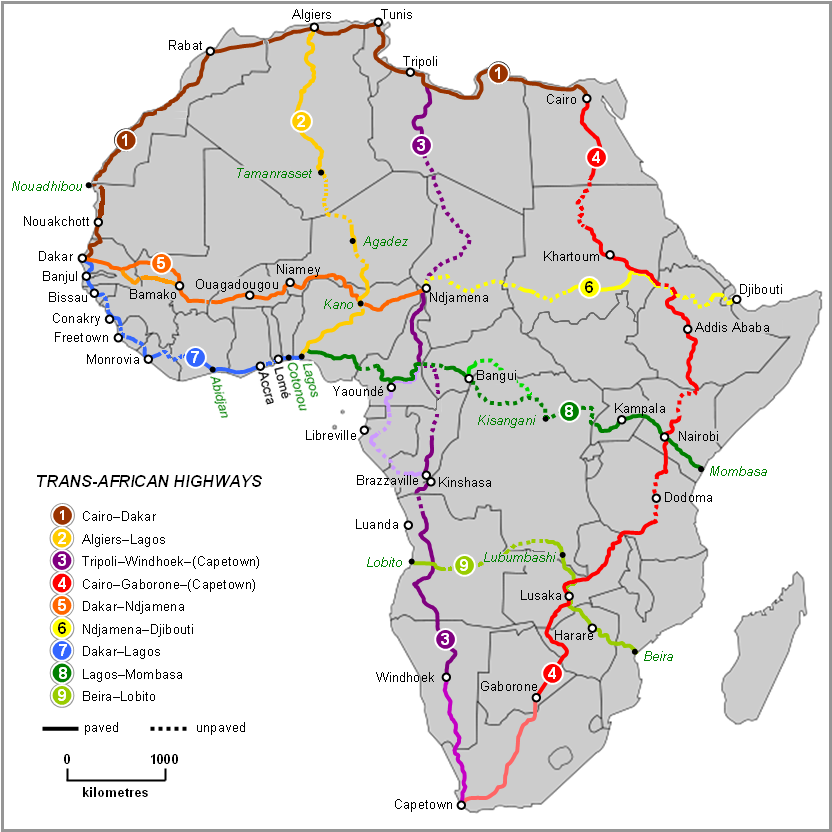

Infrastructure

African countries continue to face significant structural challenges and multiple severe shocks, including rising food and energy prices driven by geopolitical tensions such as Russia’s invasion of Ukraine, climate issues affecting agriculture and energy production, and ongoing political instability. This challenging environment has led to a slowdown in Africa’s real GDP growth from 4.1% in 2022 to 3.1% in 2023. However, the economic outlook is positive, with growth projected to reach 3.7% in 2024 and 4.3% in 2025, underscoring the strong resilience of African economies. This rebound in growth will be supported by the expected improvement in global economic conditions and effective policy measures. With these outcomes, Africa will remain the second fastest-growing region in the world, with 40 countries projected to achieve rates higher than those in 2023.

Despite these positive trends, Africa still faces challenges in achieving sustainable economic and social transformation. Historical growth rates have been insufficient to offset population growth, resulting in minimal gains in GDP per capita. Structural transformation has been limited, with economies heavily reliant on traditional low-productivity sectors such as agriculture and low-skilled services for growth and employment. To achieve substantial structural transformation, Africa needs to focus on strategic investments in key areas of the Sustainable Development Goals such as education, energy, productivity-enhancing technology and innovation, and productive transport infrastructure. The financing gap for these investments is significant, estimated to be about USD 402 billion per year through 2030, which will require increased domestic resource mobilization and private sector investment. However, given the magnitude of the resources, increasing external financial flows as complementary sources of financing is crucial. In this regard, the report highlights the urgency of reforming the global financial architecture to facilitate equitable, sustainable and inclusive allocation of resources, which is essential to financing Africa's development goals.

Governance

Governance, along with infrastructure, is the other major area for improvement in Africa.

Since 2007, the index set up by the Mo Ibrahim Foundation has been assessing the effectiveness of public action in African states and, with the scores obtained (from 1 to 100), establishing a ranking. The average score for the continent has changed slightly, from 49.9 in 2007 to 50.1 in 2016. The best regional average is in Southern Africa: 58.9; and the lowest in Central Africa: 40.9.

Africa is one of the continents where corruption is most widespread according to the NGO Transparency International: "3 countries among the 10 worst ranked are in the Middle East and North Africa region - Iraq, Libya and Sudan. In sub-Saharan Africa, 40 of the 46 countries in the region show serious corruption problems."

Informal economy

Related to governance, the informal economy is an important feature of the continent's economy.

The informal economy has been defined by the International Labour Office since 1993, with a revision in 2003, which allows for comparable measures from one country to another. Its weight in the continent's economy is considerable, between 40 and 75% of GDP (20 to 37% if only non-agricultural activity is considered), causing in particular a significant loss of tax revenue. However, the tax burden in Africa is one of the lowest in the world and is probably insufficient. According to the World Bank, "to trigger sustainable development financing, 20 to 24% of tax burden is required. The African average is around 17% (35% in rich countries); the leading African economic power, Nigeria, barely reaches 8%."

At the macroeconomic level, the informal economy is a means of social and economic resilience 700 in the face of growth that does not lead to subsequent job creation. The proportion of jobs in the informal sector is estimated to be at 66% in sub-Saharan Africa.

At the microeconomic level, in addition to tax avoidance, the informal economy also exists due to operators’ desire to circumvent administrative corruption and to dissociate themselves from poor governance and the systematic misuse of public funds. However, informal sector companies are subject to the same corruption mechanisms as formal sector companies, primarily through bribery.

For more information :

https://fr.wikipedia.org/wiki/Portail:Afrique

https://en.wikipedia.org/wiki/Africa

https://journals.openedition.org/etudesafricaines/

https://etudes-africaines.cnrs.fr/

https://www.afdb.org/fr/documents-publications/perspectives-economiques-en-afrique-2024